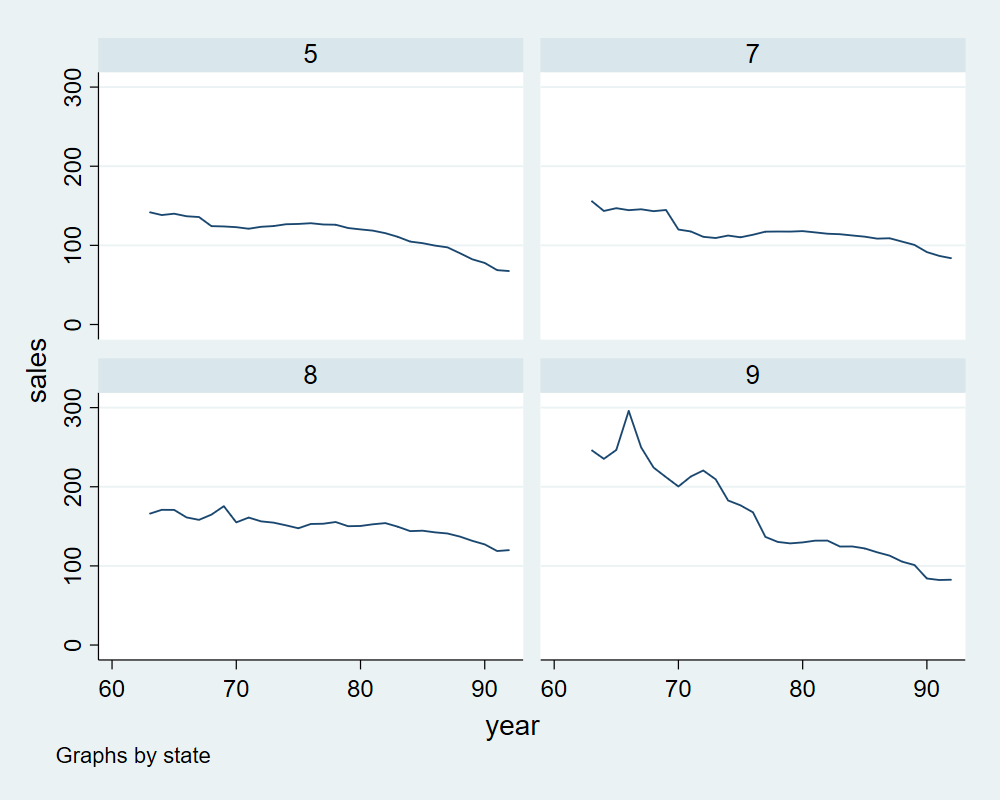

Rincón de Práctica Stata#

Datos Panel usando Stata#

Data#

import pandas as pd

import ipystata

%%stata

import delimited http://www-eio.upc.edu/~pau/cms/rdata/csv/Ecdat/Cigar.csv, clear

xtset state year

(encoding automatically selected: ISO-8859-1)

(10 vars, 1,380 obs)

Panel variable: state (strongly balanced)

Time variable: year, 63 to 92

Delta: 1 unit

Modelo FE#

\[sales_{it}=\alpha_i+x'_{it}\beta+u_{it}\]

con \(\alpha_i\) efecto fijo asociado al estado.

%%stata

xtreg sales price pop pop16 ndi, fe r

Fixed-effects (within) regression Number of obs = 1,380

Group variable: state Number of groups = 46

R-squared: Obs per group:

Within = 0.2844 min = 30

Between = 0.2740 avg = 30.0

Overall = 0.1558 max = 30

F(4,45) = 32.69

corr(u_i, Xb) = 0.1106 Prob > F = 0.0000

(Std. err. adjusted for 46 clusters in state)

------------------------------------------------------------------------------

| Robust

sales | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

price | -.3513145 .1682916 -2.09 0.043 -.6902711 -.0123579

pop | -.0087096 .0059391 -1.47 0.149 -.0206716 .0032523

pop16 | .0112986 .0092271 1.22 0.227 -.0072858 .0298831

ndi | .0010731 .0020565 0.52 0.604 -.0030689 .0052152

_cons | 141.4895 6.238091 22.68 0.000 128.9253 154.0536

-------------+----------------------------------------------------------------

sigma_u | 24.842588

sigma_e | 14.898338

rho | .73548253 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Modelo RE#

%%stata

xtreg sales price pop pop16 ndi, re r

Random-effects GLS regression Number of obs = 1,380

Group variable: state Number of groups = 46

R-squared: Obs per group:

Within = 0.2842 min = 30

Between = 0.2384 avg = 30.0

Overall = 0.1624 max = 30

Wald chi2(4) = 123.33

corr(u_i, X) = 0 (assumed) Prob > chi2 = 0.0000

(Std. err. adjusted for 46 clusters in state)

------------------------------------------------------------------------------

| Robust

sales | Coefficient std. err. z P>|z| [95% conf. interval]

-------------+----------------------------------------------------------------

price | -.3676653 .1650456 -2.23 0.026 -.6911487 -.0441818

pop | -.0087648 .0069247 -1.27 0.206 -.022337 .0048073

pop16 | .0111637 .0099851 1.12 0.264 -.0084067 .0307342

ndi | .0012399 .0020123 0.62 0.538 -.0027041 .0051839

_cons | 142.0622 7.412126 19.17 0.000 127.5347 156.5897

-------------+----------------------------------------------------------------

sigma_u | 21.045538

sigma_e | 14.898338

rho | .66616216 (fraction of variance due to u_i)

------------------------------------------------------------------------------

Modelo Two-way FE#

\[sales_{it}=\mu_i+\mu_t+x'_{it}\beta+u_{it}\]

con \(\alpha_i\) efecto fijo asociado al estado y \(\mu_t\) efecto fijo asociado al año.

%%stata

reghdfe sales price pop pop16 ndi, absorb(state year) vce(r)

(MWFE estimator converged in 2 iterations)

HDFE Linear regression Number of obs = 1,380

Absorbing 2 HDFE groups F( 4, 1301) = 47.62

Prob > F = 0.0000

R-squared = 0.8467

Adj R-squared = 0.8375

Within R-sq. = 0.2304

Root MSE = 12.4910

------------------------------------------------------------------------------

| Robust

sales | Coefficient std. err. t P>|t| [95% conf. interval]

-------------+----------------------------------------------------------------

price | -.8296836 .0894201 -9.28 0.000 -1.005107 -.6542602

pop | -.0025949 .0019491 -1.33 0.183 -.0064187 .0012288

pop16 | .0040946 .0025701 1.59 0.111 -.0009475 .0091366

ndi | -.0057015 .0008145 -7.00 0.000 -.0072994 -.0041037

_cons | 221.843 7.428401 29.86 0.000 207.2701 236.416

------------------------------------------------------------------------------

Absorbed degrees of freedom:

-----------------------------------------------------+

Absorbed FE | Categories - Redundant = Num. Coefs |

-------------+---------------------------------------|

state | 46 0 46 |

year | 30 1 29 |

-----------------------------------------------------+

Panel Dinámico#

\[sales_{i,t}=sales_{i,t-1}+\mu_i+x'_{i,t}\beta+u_{i,t}\]

con \(\alpha_i\) efecto fijo asociado al estado

%%stata

xtabond sales price pop pop16 ndi, vce(robust)

Arellano–Bond dynamic panel-data estimation Number of obs = 1,288

Group variable: state Number of groups = 46

Time variable: year

Obs per group:

min = 28

avg = 28

max = 28

Number of instruments = 411 Wald chi2(5) = 15775.72

Prob > chi2 = 0.0000

One-step results

(Std. err. adjusted for clustering on state)

------------------------------------------------------------------------------

| Robust

sales | Coefficient std. err. z P>|z| [95% conf. interval]

-------------+----------------------------------------------------------------

sales |

L1. | .8646417 .0236058 36.63 0.000 .8183752 .9109082

|

price | -.0661191 .0353343 -1.87 0.061 -.1353731 .0031348

pop | -.0046988 .0030159 -1.56 0.119 -.0106099 .0012122

pop16 | .0056149 .0036481 1.54 0.124 -.0015352 .012765

ndi | -.0000592 .0003699 -0.16 0.873 -.0007841 .0006658

_cons | 23.41488 3.986634 5.87 0.000 15.60122 31.22854

------------------------------------------------------------------------------

Instruments for differenced equation

GMM-type: L(2/.).sales

Standard: D.price D.pop D.pop16 D.ndi

Instruments for level equation

Standard: _cons